Man Funds VI plc - Man TargetRisk D H SGDRegistreer u om de ratings zichtbaar te maken |

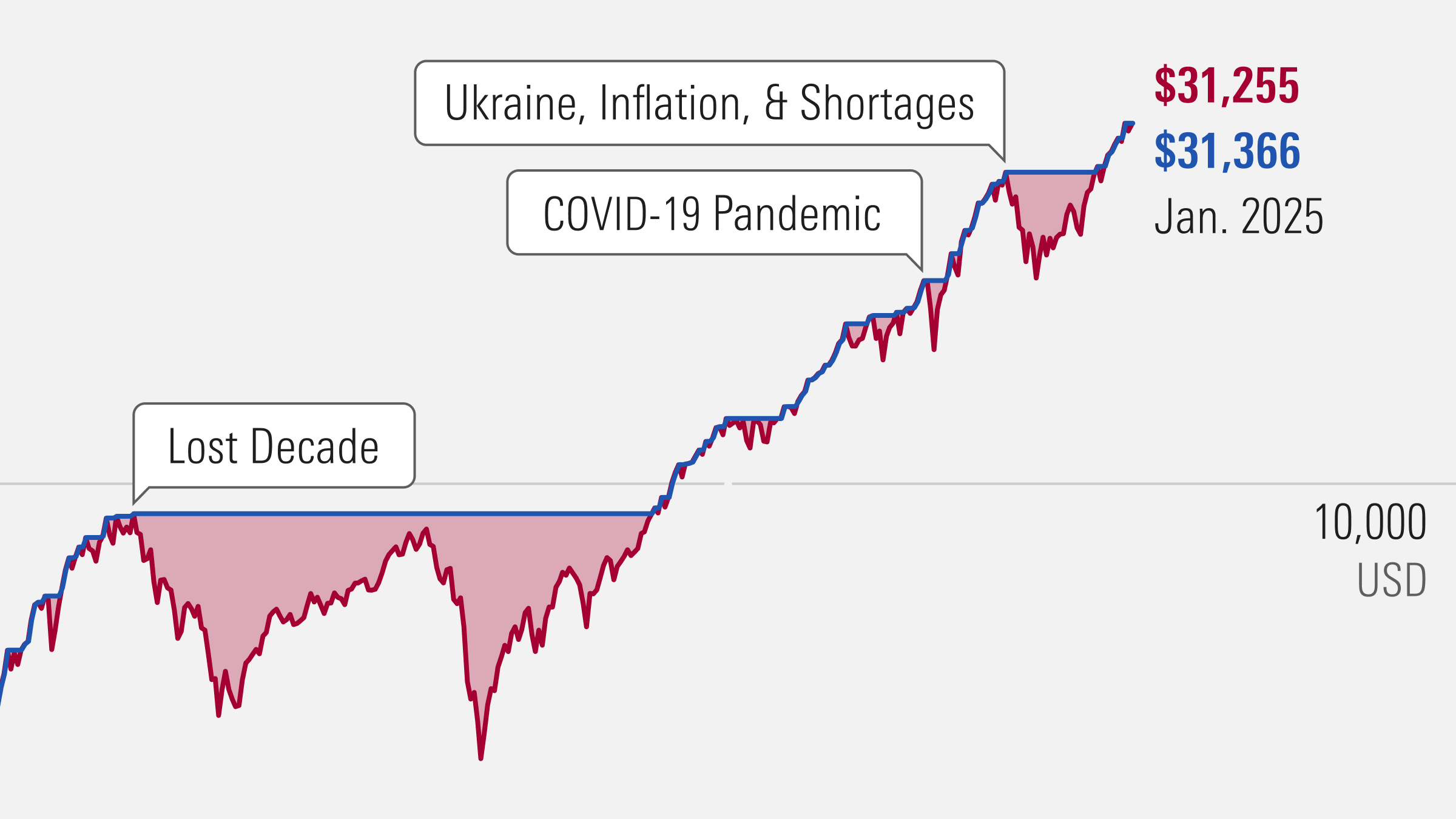

| Hoe heeft dit fonds gepresteerd? | 30-04-2025 |

| Ontwikkeling van EUR 1000 (EUR) | Uitgebreide Grafiek |

| Fonds | 19,6 | -11,7 | 9,5 | 7,7 | -11,6 | |

| +/-Cat | - | - | - | - | - | |

| +/-Idx | - | - | - | - | - | |

| Categorie: Mixfondsen Overig | ||||||

| Categorie Benchmark: - | ||||||

| Kerngegevens | ||

| Koers 07-05-2025 | SGD 108,12 | |

| Rendement 1 Dag | -0,21% | |

| Morningstar Categorie™ | Mixfondsen Overig | |

| Vestigingsland | Ierland | |

| ISIN | IE00BRJT7F08 | |

| Grootte Fonds (Mil) 07-05-2025 | USD 2718,74 | |

| Grootte Fondsklasse (Mil) 07-05-2025 | SGD 2,00 | |

| Aankoopkosten (Max) | - | |

| Lopende Kosten Factor 27-03-2025 | 1,70% | |

| Beleggingsdoelstelling: Man Funds VI plc - Man TargetRisk D H SGD |

| The Portfolio aims to generate capital growth over the medium to long term by providing dynamic long only exposure to a range of assets and to provide an excess return stream with a stable level of volatility regardless of market conditions. The Portfolio will seek to achieve its objective by allocating all or substantially all of its assets in accordance with a proprietary quantitative model, the strategy, to provide an excess return stream with a stable level of volatility regardless of market conditions. |

| Returns | |||||||||||||

|

| Management | ||

Naam manager Aanvangsdatum | ||

Russell Korgaonkar 11-12-2014 | ||

Otto van Hemert 01-01-2021 | ||

Oprichtingsdatum 20-08-2019 | ||

| Advertentie |

| Categorie Benchmark | |

| Benchmark van het fonds | Benchmark Morningstar |

| 40% Bloomberg Global Aggregate TR USD , 60% MSCI World NR USD | - |

| Target Market | ||||||||||||||||||||

| ||||||||||||||||||||

| Waar belegt het fonds in? Man Funds VI plc - Man TargetRisk D H SGD | 31-03-2025 |

| ||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

Afname

Afname  Nieuw t.o.v. vorige portefeuille

Nieuw t.o.v. vorige portefeuille